How the Federal Reserve's Next Move Could Affect the Housing Market

With September here, all eyes are on the Federal Reserve (the Fed) as they prepare for their next meeting. Expectations are high that the Fed will cut the Federal Funds Rate due to signs of cooling inflation and a slowing job market. According to Mark Zandi, Chief Economist at Moody’s Analytics, “They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

So, how will this potential rate cut impact the housing market, and what does it mean for you as a homebuyer or seller?

Why a Federal Funds Rate Cut Matters for Housing

The Federal Funds Rate plays a significant role in influencing mortgage rates, alongside other factors like the broader economy and geopolitical events. When the Fed cuts this rate, it signals shifts in the economy, often leading to lower mortgage rates. While one rate cut won’t drastically drop mortgage rates, it will likely contribute to the gradual decline we’ve already been seeing.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains, “Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

This potential cut may not be a one-time event, either. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), predicts, “Six to eight rounds of rate cuts through 2025 look likely.”

Projected Impact on Mortgage Rates

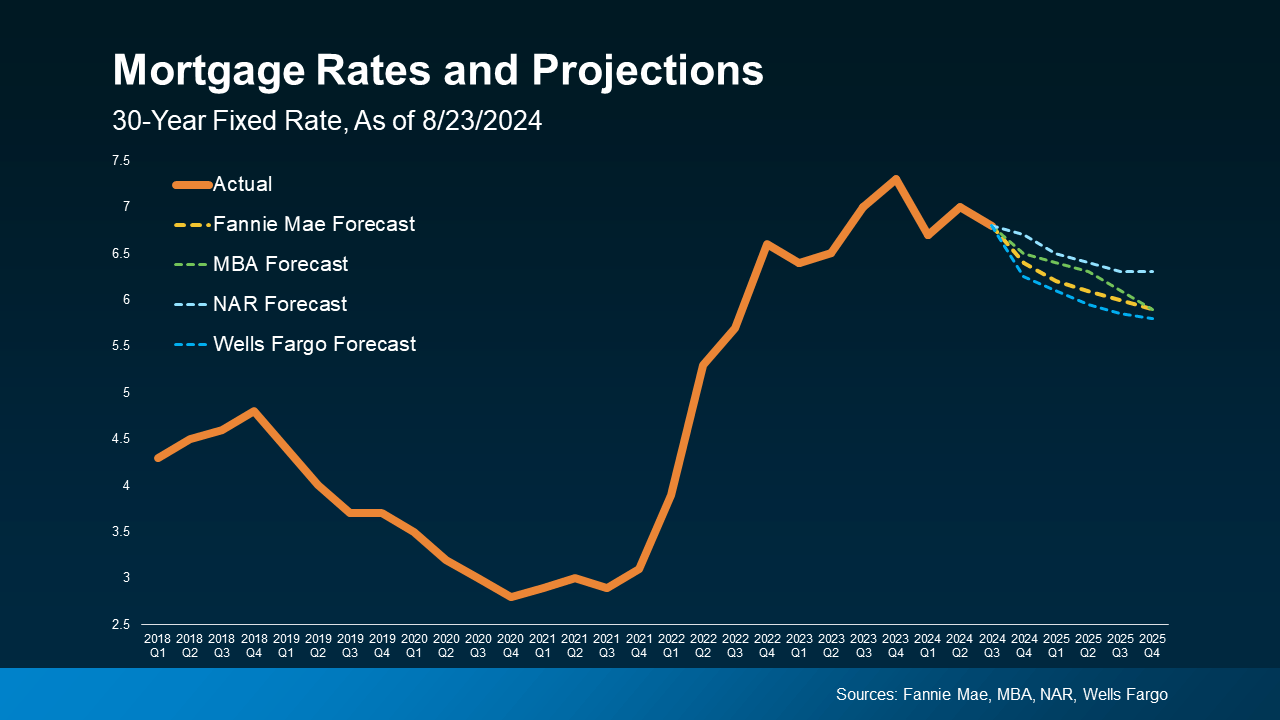

Mortgage rates are already on a slow downward trend, and further rate cuts from the Fed are expected to keep that momentum going. Experts from Fannie Mae, MBA, NAR, and Wells Fargo project a moderate decline in rates through 2025.

Here’s why this matters for you as a buyer or seller:

1. Eases the Lock-In Effect for Sellers

Many current homeowners feel stuck due to the "lock-in effect," where they hesitate to sell because their current mortgage rate is lower than what’s available today. A slight reduction in mortgage rates could make selling more appealing for some homeowners, though it’s unlikely to trigger a huge surge in listings.

2. Increases Buyer Activity

For potential buyers, even a small drop in mortgage rates can make homeownership more affordable. Lower rates mean reduced monthly payments, which can make it easier for you to jump into the market.

What Should You Do?

While the Fed’s upcoming rate cut won’t dramatically drop mortgage rates, it will likely contribute to ongoing improvements. Still, it’s essential to focus on your personal circumstances rather than trying to time the market. As Jacob Channel, Senior Economist at LendingTree, says, “If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The Federal Reserve’s expected rate cut could lead to a gradual reduction in mortgage rates, which is good news for both buyers and sellers. If you’re thinking about buying or selling a home, let’s connect so you’re ready to take advantage of the opportunities that arise.